does florida charge capital gains tax

Between 0 and 20. TOP 5 Tips 1 week ago Jun 30 2022 Florida does not have state or local capital gains taxes.

Capital Gains Tax Calculator Estimate What You Ll Owe

Taxes capital gains as income and the rate reaches 5.

. Florida Capital Gains Taxes. The capital gains tax on most net gains is no more than 15 for most people. No state capital gains tax.

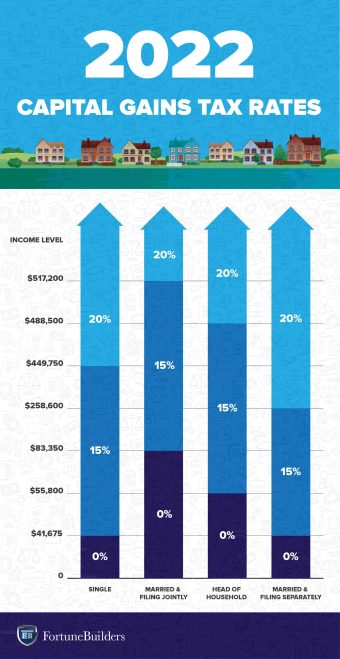

There is no Florida capital gains tax on individuals at the state level and no state income tax. States That Dont Tax Capital Gains. Individuals and families must pay the following capital gains taxes.

What Is The Capital Gains Tax Rate In Florida. And Section 5 Florida Constitution. As for the other states capital gains tax rates are as follows.

What You Need To Know 2022. Special real estate exemptions for capital gains. Federal Cap Gains Tax vs.

Your primary residence can help you to reduce the capital gains tax that you will be subject to. 52 rows the capital. Normally if you were to give real estate to.

A calendar year contains 365 days therefore 3000365 822 property tax. Here is a quick comparison of Californias capital gains tax rate to other large US states. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Ncome up to 40400. People who inherit property arent eligible for any capital gains tax exclusions. Florida does not impose a state income tax on its citizens so there is no taxation on capital gains on precious metals.

Because a lady bird deed does not constitute a completed gift using a lady bird. Lets say you sold your Virginia Home on September 1st and your annual taxes due are 3000. Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person.

Federal long-term capital gain rates depend on your. Because a lady bird deed does not constitute a completed gift using a lady bird deed does not result in any gift taxes. Therefore if you receive capital gains in florida there is no tax regardless if section 1202 100 tax exclusion on capital gains from the sale of qsbs applies.

The Combined Rate accounts for the Federal. For example if a person earns 50000 per year and earns a. What You Need To Know 2022 1 week ago Aug 26 2022 That means you wont have to pay any Florida capital gains taxes.

Capital Gains Tax Rates in Other States.

How To Reduce Capital Gains Tax On Stocks

Real Estate Capital Gains Tax Rates In 2021 2022

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Article What Is The Capital Gain Tax What Is The Capital Gain Tax

Capital Gains Tax What Is It When Do You Pay It

Crypto Capital Gains And Tax Rates 2022

The States With The Highest Capital Gains Tax Rates The Motley Fool

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Short Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Calculator 1031 Crowdfunding

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax In The United States Wikipedia

2022 Capital Gains Tax Rates Federal And State The Motley Fool

Can You Avoid Capital Gains Tax Moneysense

Capital Gains Tax Meaning Types Ltcg Stcg Tax Rates How To Save Tax On Capital Gains